[pods name=”amplispot_custom_setting_page” id=”43″ field=”name_of_the_company”] helps you choose from a variety of personal insurance and business insurance solutions.

Brewery Liability Insurance provided by [pods name="amplispot_custom_setting_page" id="43" field="name_of_the_company"] .

The brewing industry is growing. With growth comes risk, including potential business interruptions due to equipment breakdown, contamination costs and product recalls.

What Is Brewery Insurance?

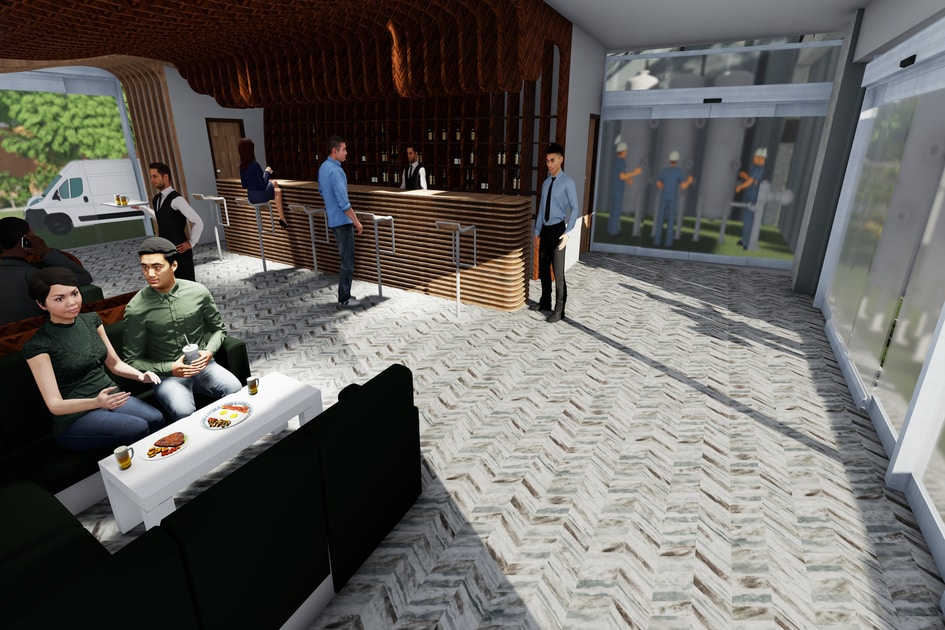

Brewers require a mix of standard business and industry-specific coverages. Brewers need insurance with industry-specific coverages and services that address the unique needs of food manufacturers and processors from production to delivery. The specifics of brewery insurance plan depends on the type of brewery (large brewery, microbrewery, craft brewery, etc.) and whether there is a tasting room, restaurant, pub, or other on-site operations like axe-throwing or lawn darts.

Why Do Breweries Need Insurance?

As a proud manufacturer of stouts, lagers, and ales, you, unfortunately, must also prepare your business for unexpected events that can damage property, suspend production, injure customers or employees, and cause serious financial distress. Consider the following scenarios:

- A batch is contaminated or spoiled and must be destroyed or removed from the marketplace.

- A customer is involved in an alcohol-related car accident after leaving your tasting room or brewpub.

- Vital equipment or machinery unexpectedly breaks down, leading to property damage, loss of inventory or product, and extended downtime.

- A customer, vendor or delivery person slips, trips, or falls on your property.

- Guests on your property damage equipment or other business property.

- Unfinished or completed beer leaks or spills from a storage tank.

- Weather events, fire, theft, or vandalism damages or destroys your building(s) and its contents.

- Beer in storage or in transit is damaged or destroyed.

As you can see, risks for a brewery can come from all different directions. And because each brewery’s needs differ from another, you may need to combine a few different insurance policies and endorsements to properly cover your business.

Whatever it is you should be thinking about it when choosing your brewery insurance coverage. In any business, the things that happen that you didn’t prepare for can bankrupt your business without the proper coverage.

What Type Of Insurance Do Breweries Need?

Brewery insurance has the right recipe of coverages to meet the unique

needs of your business. Standard property and liability coverages can be customized and blended to create specialized protection that delivers peace of mind while you focus on your next product or output cycle.

Some of the types of coverages that you should consider

- Property, Equipment Breakdown and Business Interruption Coverages

- General Liability, Liquor Liability and Umbrella Coverages

- Product Recall Coverage

- Workers Compensation

- Auto Insurance

- Cyber Insurance

- Inland and Ocean Marine Coverages

As your brewery grows, it will be important to regularly monitor your insurance coverage so that you have enough protection. Buying more equipment and hiring more employees, for instance, are likely to lead to higher insurance costs. Check in with us each time you’re looking at expanding your business.

Connect with us today to review your existing policies and see how much you could save on your insurance.